Recognize Trusted Customers and Prevent Fraud

Harness the power of global shared intelligence

Reimagine the customer experience

Companies are undergoing digital transformations, changing how they do business to match the expectations of today’s always-connected consumers. Customers want a frictionless online experience in which the companies they frequent recognize them, no matter what device they’re using at the time. They expect access, convenience and consistency across all platforms and touchpoints throughout their journey.

Businesses that don’t embrace changing technology will be left behind. But customer expectations must be balanced with fraud protection. Cybercriminals have become more sophisticated in their use of bots and synthetic identities. And the increasing occurrence of global data breaches means stolen identity data is pervasive on the dark web, giving fraudsters the information they need to masquerade as customers and perpetrate crimes. Fraud protection can’t be sacrificed to provide customers with frictionless transactions.

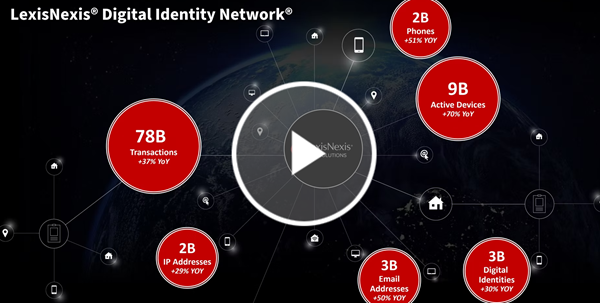

The Digital Identity Network® is a proven solution that gives businesses the ability to detect and block complex fraud in near real time while also minimizing friction for trusted customers.

Uniting offline behavior with online intelligence

At the heart of the Digital Identity Network® is LexID® Digital, a unique customer identifier. It provides a 360-degree view of customers by merging offline and online data in near real time to establish true digital identities. It detects synthetic and stolen identities as well as unusual behavior such as location anomalies, new email addresses originating from the same device, or new shipping addresses.

The key elements of LexID Digital are:

- Unique identifier—A tokenized alphanumeric identifier for each of 1.4 billion recognized users across the Digital Identity Network®

- Confidence score—A dynamic score that represents the likelihood a current event is associated with a designated LexID® Digital Identity. Low confidence scores suggest fraudulent identities

- Graph visualization—An interactive picture of all the devices, credentials, threats and behavioral attributes related to an identity

- Trust score—A dynamic score that reflects the reputational integrity of the LexID® Digital Identity for current and future transactions

The network’s unique components

The Digital Identity Network® has three main components that make it particularly effective at connecting the dots:

- Digital identity intelligence—Obtains crowdsourced intelligence comprised of web and mobile device identification; true location and behavior analysis; identity and link analysis; and bot and malware threat intelligence

- Dynamic decision platform—Uses digital identity intelligence, behavioral analytics, machine learning, external data sources and case management to continually improve decisions

- Smart authentication—Combines frictionless risk-based authentication with low-friction strong customer authentication such as device binding, multi-factor authentication and biometrics to create an enhanced customer experience

Advantages of the LexisNexis Digital Identity Network®

The Digital Identity Network® uses leading-edge technology to catch fraud before it happens and facilitates the successful transaction of business for genuine customers.

- An extensive network—The Digital Identity Network® leverages massive amounts of data from about 3 billion monthly transactions.

- All-inclusive solution—Get powerful fraud and authentication decisioning across all use cases and throughout the customer journey from new account registration and onboarding to every transaction that follows.

- Clear visibility into digital identities—By combining a unique identifier, a confidence score and a visualization graph, you gain comprehensive insight into a customer across all channels and touchpoints.

- Integrated approach—When you incorporate real-time event and session data, third-party signals, and global intelligence into a single smart authentication framework, the result is a seamless, low-friction experience for the customer.

- Advanced behavioral analytics and machine learning—The analysis of dynamic user behavior helps to build more accurate risk models, resulting in fewer false positives and the lowest possible fraud levels.

- Privacy—Using tokenization, you get a dynamic risk assessment of identities while ensuring customer data remains confidential.

- Fast, easy deployment—A cloud-based solution, it provides simple and straightforward integration with existing systems.

Customer experience defines your brand

When customers connect with you, they expect to be recognized and well treated, regardless of the channel they’re using. Companies that consistently deliver a positive customer journey build powerful brand loyalty. But that loyalty can’t come at the expense of increased fraud.

Fortunately, with the right proactive fraud prevention solution—one that employs leading-edge technology fueled by massive data—you can minimize losses while raising the bar on customer experience.

Discover how the Digital Identity Network® can help you detect and block fraudsters in near real time while ensuring quality interactions for your trusted customers.